Matchless Info About How To Get A Irs Pin Number

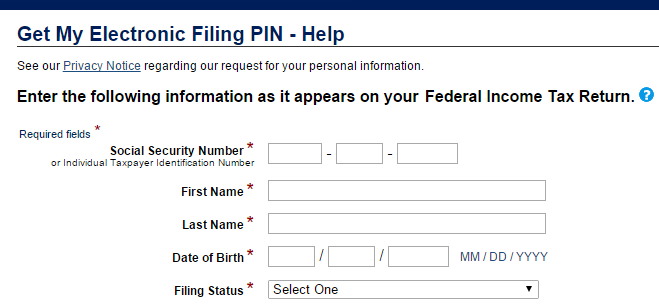

The opening page will list the items you need to prove your identity and retrieve your pin.

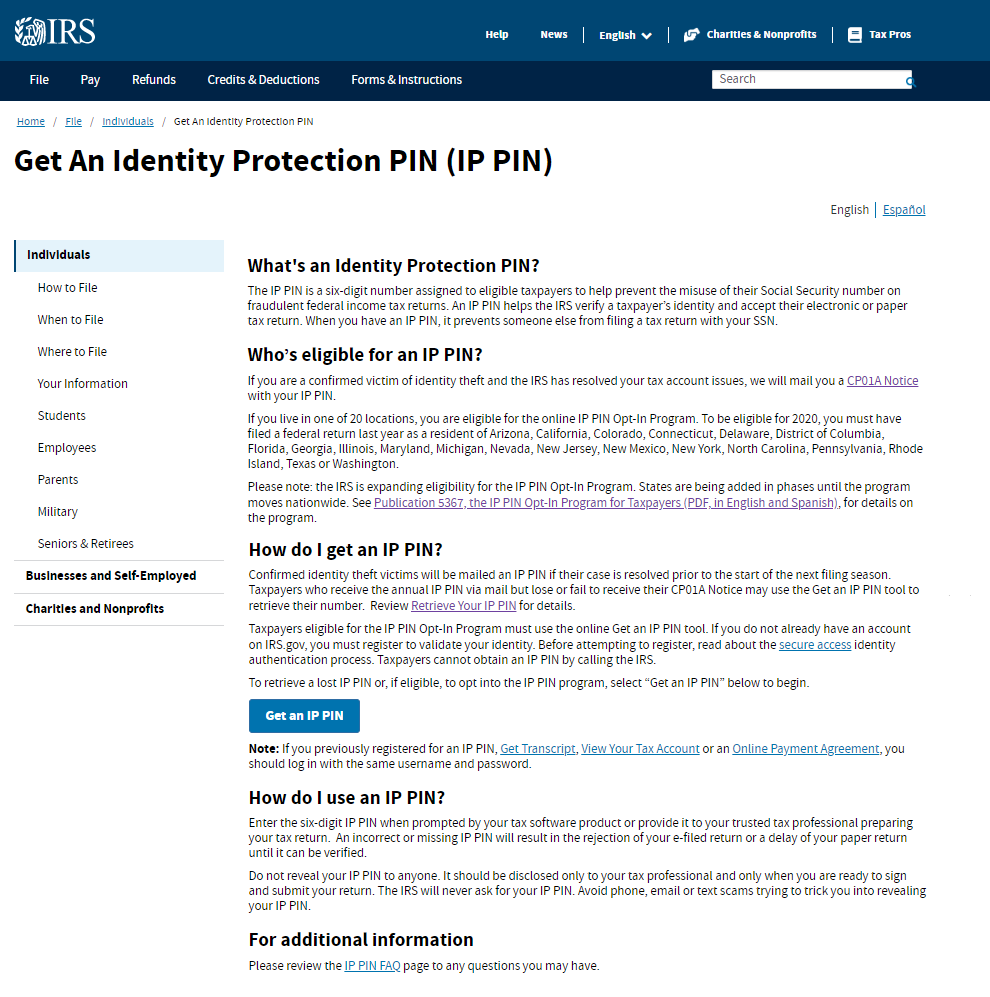

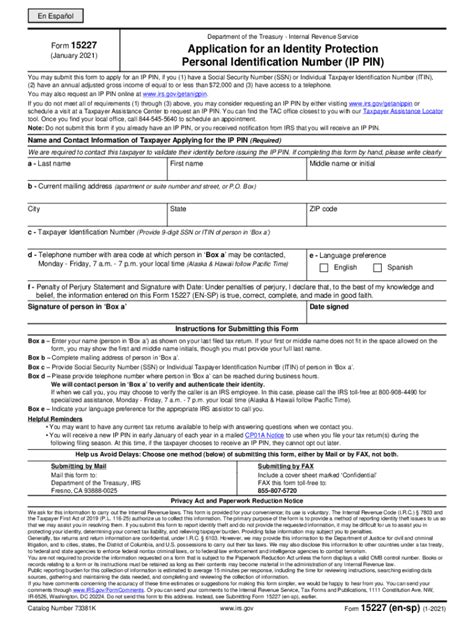

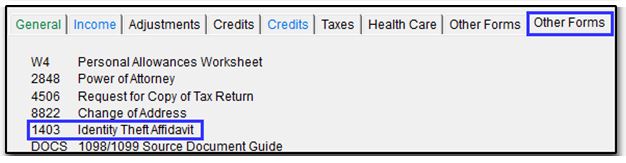

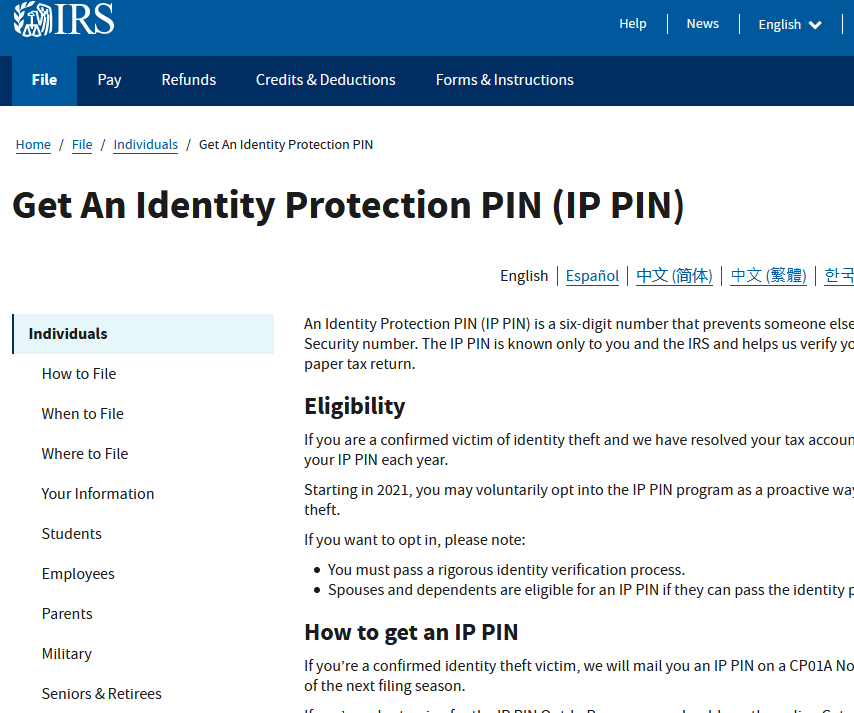

How to get a irs pin number. Once you have an irs.gov account, go to the get an identity protection pin page and click on the blue get an ip pin button. Go to the irs website using the irs website is the easiest way to get an irs ip pin. If you do not have a copy of your tax return, you can get your agi from one of the irs self.

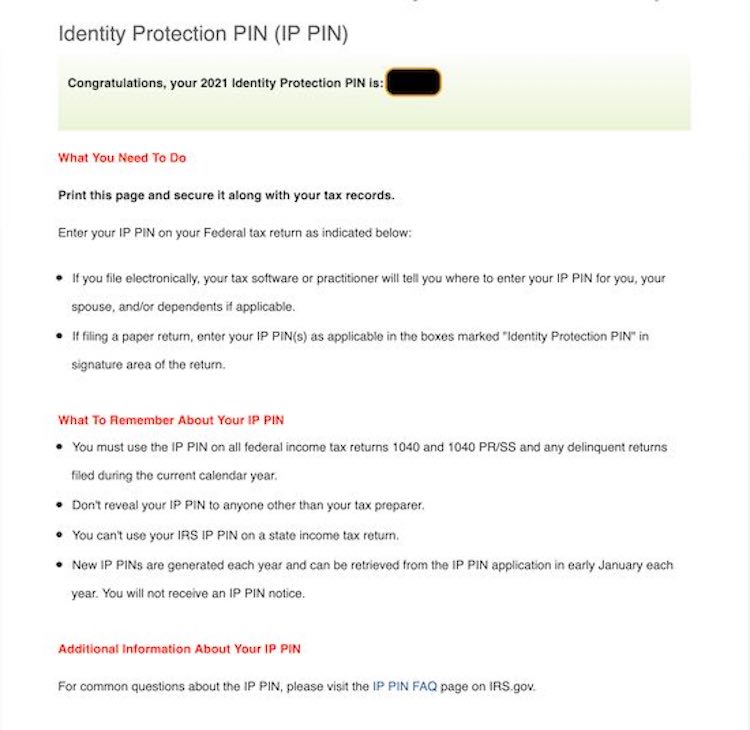

After you create an online account, use the “get an ip pin” button on the irs website to register. You can protect yourself with an ip pin number from the irs. You must verify your personal.

You can get your current ip pin by using the get an ip pin application. Use this online irs pin tool to get your pin. You may also call irs at.

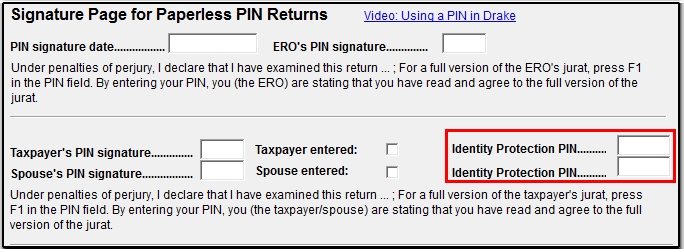

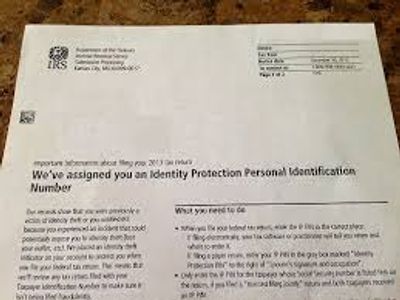

You will receive the pin in a sealed. Access your account if you already have an online ptin account, login now. This means you have to.

You can retrieve your ip pin from the irs by accessing the irs ip pin application. If you lost the ip pin or didn’t receive one in the mail, visit retrieve your ip pin. The system will walk you through the process of.

You can use the irs ip pin tool between mid. To get an ip pin that is lost, forgotten, or never arrived in a cp01a notice, use the ip pin request portal at irs.gov. According to the irs, applicants must.